How My Developer Skills Made Me a Better Forex Trader

Discover how my web development background became my secret weapon in forex trading - from automated systems to data-driven decisions.

🕒 3 min read

The “Aha!” Moment

I’ll never forget the day I realized my coding background was my secret weapon in forex trading. I was staring at charts for hours, trying to spot patterns manually, when it hit me: “I’m a developer—why am I doing this like everyone else?”

That moment changed everything. Here’s how my tech skills transformed my trading journey.

1. Data Analysis: From Guesswork to Precision

Before (Manual Trading):

- Staring at charts for hours

- Emotional decisions based on “gut feeling”

- Inconsistent results

After (Developer Approach):

# Simple momentum analysis script I built

import pandas as pd

import numpy as np

def analyze_trend(data):

# Calculate moving averages

data['MA_20'] = data['close'].rolling(20).mean()

data['MA_50'] = data['close'].rolling(50).mean()

# Identify trend direction

data['trend'] = np.where(data['MA_20'] > data['MA_50'], 'bullish', 'bearish')

return data

Result: I went from guessing trends to quantifying them with actual data.

- Automation: Trading While I Sleep The Problem: Missing opportunities during work hours

Emotional trading after long days

Inconsistent trade execution

My Solution: I built a simple Python bot that:

Monitors specific currency pairs

Executes trades based on predefined rules

Sends me Telegram notifications

The Impact: My trading became systematic, not emotional.

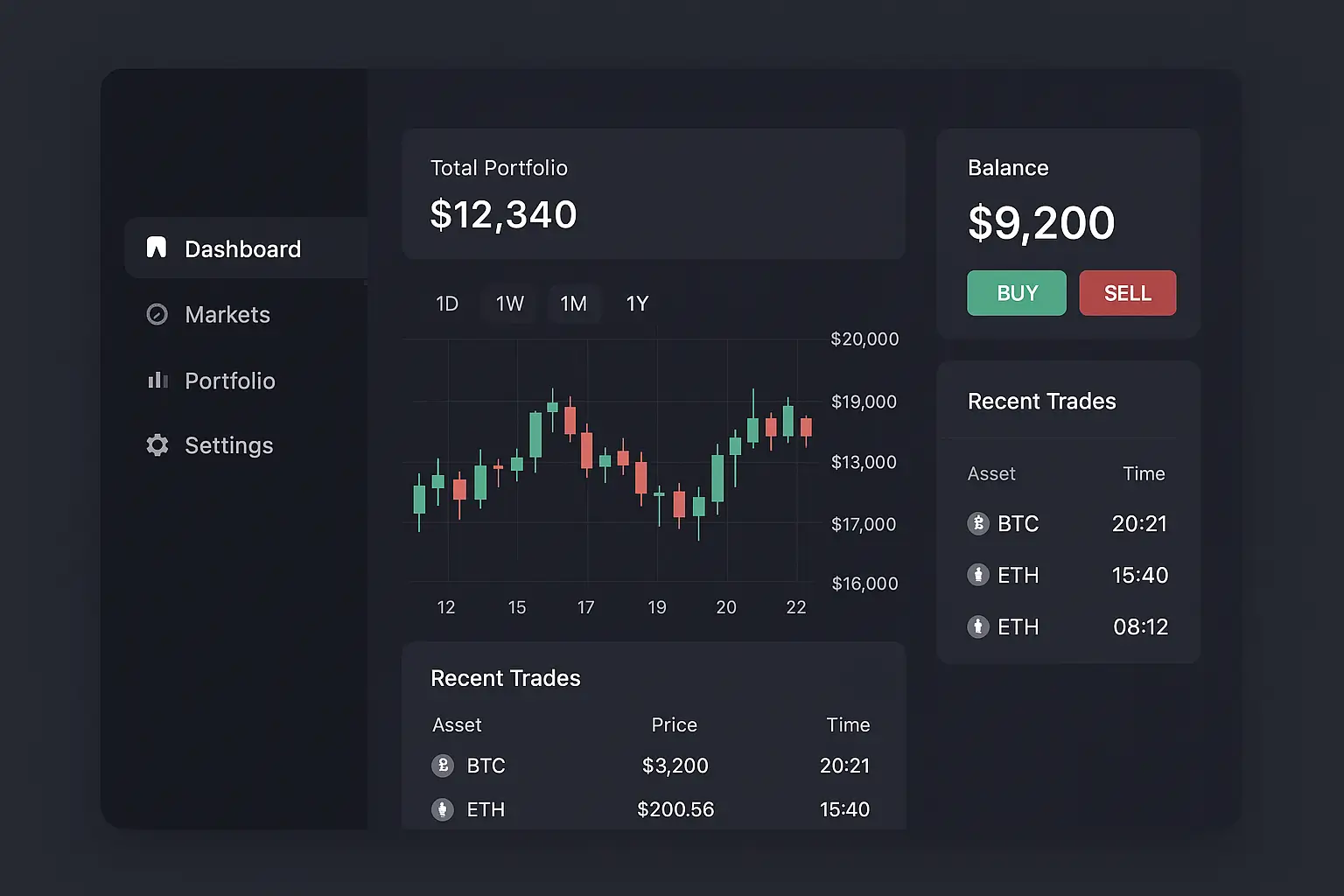

- Custom Tools: Building What Didn’t Exist My Trading Dashboard: Instead of paying for expensive platforms, I built my own with:

Next.js frontend

Python backend for analysis

Free APIs for market data

Features I added that commercial platforms lack:

Custom risk calculators

Personal trade journal integration

Algorithm performance tracking

- Risk Management: Code-Based Discipline The Developer Mindset Applied to Trading:

Risk management rules I coded

def calculate_position_size(account_balance, risk_per_trade=0.02): max_risk = account_balance * risk_per_trade position_size = max_risk / (entry_price - stop_loss) return min(position_size, account_balance * 0.1) # Max 10% of account

Why this works: The code doesn’t get greedy or fearful—it just follows the rules.

- Backtesting: Learning from History My Approach: Instead of risking real money on untested strategies, I:

Wrote scripts to test strategies on historical data

Analyzed performance metrics (win rate, drawdown)

Optimized based on data, not emotions

Result: I avoided costly mistakes by testing strategies virtually first.

Practical Tools Any Developer-Trader Can Use Free Resources I Started With: Python libraries: pandas, numpy, matplotlib

Broker APIs: Most major brokers offer free API access

Data sources: Yahoo Finance, Alpha Vantage (free tier)

My Current Stack: Analysis: Python + Jupyter notebooks

Automation: Custom scripts + broker API

Visualization: TradingView + custom dashboards

Journaling: Notion API + custom database

The Biggest Lesson: Systems Over Emotions As developers, we’re trained to think in systems. This mindset was my game-changer:

Before: “I feel like EUR/USD will go up” After: “My system shows a 68% probability of upward movement based on these 5 indicators”

Your First Step: Start Small You don’t need to build complex algorithms overnight. Start with:

A simple spreadsheet to track your trades systematically

Basic Python script to analyze your trading history

Custom indicators on TradingView (they have a scripting language)

Ready to Bridge Your Skills? If you’re a developer interested in trading (or a trader learning to code), you have a unique advantage. The intersection of these skills is where real edge is found.

Next week, I’ll share: “How to Build Your First Trading Dashboard with Python” - a step-by-step guide for developers.

Discussion Questions: What tech skills have helped your trading?

What trading problems could you solve with code?

Any specific tools you’d like me to cover?

Let me know in the comments below! 👇

Comments & Discussion

Join the conversation using your GitHub account. Comments are powered by Utterances.